The new Government Housing Fund Company, or FHFA, compares the fresh new federal average home worth out of October of your own past year to the present one. If you have a growth, the compliant financing limitation is raised correctly. This time around, home prices flower from the fourteen% and so did brand new compliant limitation.

For the majority places, this new 2022 Conforming Mortgage Restrict is actually $647,200 to own an individual-house. In the very-entitled large prices section, in which the median home prices to the area meet or exceed 115% of the local average family worth, the high cost compliant financing restriction is risen up to $970,800. Every highest-prices towns try concentrated inside claims eg Ca, Fl, Alaska, Hawaii, Colorado, Virginia-DC and you may Brand new The united kingdomt.

Jumbo Loan Laid out:

Anything over the compliant loan maximum is considered a good jumbo mortgage. What are the very first differences when considering a compliant and you may a beneficial jumbo mortgage? The most important distinction is the rates awarded for every single. Jumbo fund generally carry a somewhat high interest rate ranging from 0.25% to 0.50%, dependant on borrowing and loan so you can worth.

Almost every other variations is down-payment criteria. Jumbo finance, eg conforming finance, promote different rates formations for the same system based on borrowing ratings and down payment numbers. The number one prices are kepted of these that have a down fee of at least 20% and a credit score during the otherwise above 720 for most software.

The primary reason conforming fund keeps somewhat down costs than jumbo funds is during biggest region considering the additional market. When a loan provider otherwise bank approves a conforming loan playing with Fannie standards, the loan could easily be offered directly to Fannie if you don’t for other loan providers.

Lenders promote loans so you can take back dollars to cover the fresh software. One another Fannie and you may Freddie combine for taking right up as much as several-thirds of the many mortgages approved today, plus higher-rates components.

Jumbo Financial Being qualified:

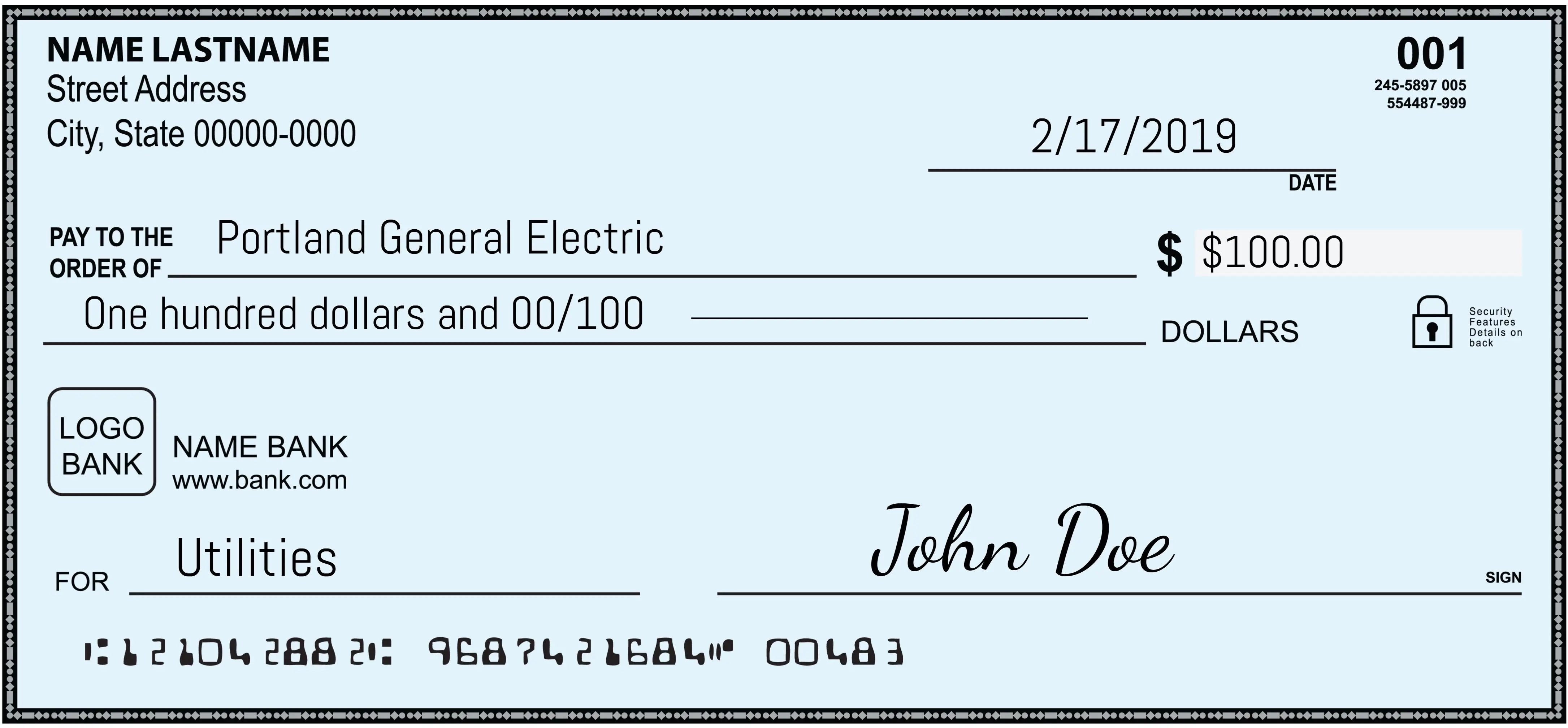

Qualifying for a good jumbo loan is very much particularly qualifying getting a compliant mortgage. Lenders often be sure money and you may work by examining duplicates away from an effective borrower’s newest shell out stubs covering a 60 day period together to the past 2 years off W2 variations.

For somebody which is notice-operating otherwise obtains more than twenty five% of their terrible annual money off present aside from a manager, 2 years out of government tax yields are expected. Whenever evaluating federal tax yields, the lender often compare the season-over-season net gain getting mind-work and mediocre both of these years to make the journey to good month-to-month number.

Including, just one filed online payday loans Ottawa Illinois income tax productivity and you will displayed $150,one hundred thousand in one 12 months and you may $165,000 next year. They are the several most recently filed output. $150,100000 + $165,100 = $315,000. $315,100000 separated by 24 (months) = $13,125. $13,125 is the amount used in qualifying.

Lenders want to see particular consistency from a single year on second and are cautious about any significant miss-removed from 1 year to another. For-instance, 1 year the cash was $165,100 additionally the 2nd $150,100000. While which is a decrease, a lender carry out only consider it a nominal changes and you can regular to have a business. If the decrease is more than ten-20%, the lender need a reason about your decline that can even ignore the application.

Work is actually verified from the connecting individually for the company verifying money, the length of time the latest staff has worked truth be told there plus the possibilities the brand new staff member will remain employed certainly other stuff. To make sure discover enough noted fund readily available for a good down-payment and you will closing costs, as copies out-of lender and you will funding statements because of these accounts often be needed.